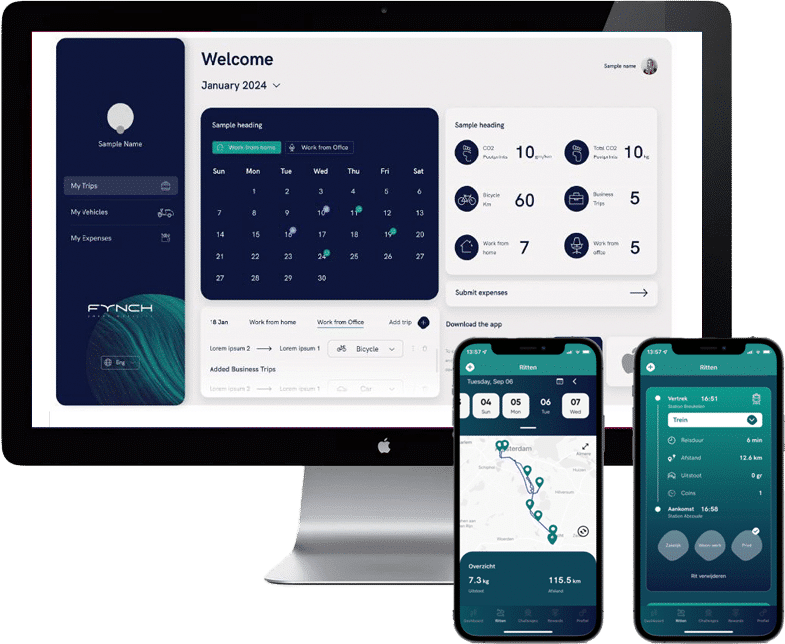

Software for sustainable mobility

You want to be an attractive employer and offer your employees a flexible and sustainable mobility policy. This can be done easily and efficiently. Fynch enables you to set customized expense rules and employees can easily register and declare all their trips and expenses. This saves time, money, and CO₂. And you immediately comply with CO₂ reporting laws such as the CSRD reporting legislation.

- Easily reimburse trips and travel expenses

- Provide a flexible and sustainable mobility policy

- Save time and money

- Facilitate a mobility budget

- Comply with CO₂ reporting legislation and CSRD

- Annual CO₂ reduction > 10%

- Happy employees

- Simple implementation

Did you hear us on BNR?

Listen to the broadcast here!

How does it work?

Fynch offers a solution for employers who wish to gain insight into their CO₂ footprint and facilitate employees with a sustainable and flexible mobility policy. With Fynch you can easily set up mobility expense rules and offer your employees a lot of convenience when registering and reimbursing business trips, commutes and work from home days. You decide which solution you need and when. Start today with Fynch Basic and easily upgrade to our complete Fynch Enterprise package. Everything is possible.

- 24/7 insight into all company-related mobility

- Intuitive manual registration or fully automatic

- Reward sustainable and healthy travel behavior

- Variable km reimbursements

- Automated declaration process

Avoid fines, don't miss the July 1 deadline

Avoid fines for failure to comply with the reporting requirement work-related mobility of persons. Fynch’s software makes it easy to comply. Discover how our WPM Survey tool can help your organization to effectively meet the reporting requirement on time.

Mission: to make impact together

Our mission is to activate 10 million people to travel sustainable and healthy by 2030.

We help organizations achieve carbon-neutral mobility as soon as possible by motivating employees to travel active and sustainable.

How does Fynch Mobility work?

We are here to answer all your questions about Fynch

With many employers, declaring travel and work from home days is still done via an excel form. That means you have to keep track of every trip manually and declare it at the end of the month.

This takes an average of about 2 hours per employee per month.

With Fynch Mobility, you can record every business travel movement automatically. At the end of the month, you do a check and the declarations are processed. This takes you a maximum of 5 minutes.

To comply with the reporting requirement, you must send all employees a survey in which they must fill in their own travel kilometers. This means, first of all, that you have to create and send a survey. The employees must then calculate and fill in the travel kilometers themselves, which can lead to errors. In addition, the data needs to be supplemented with other sources such as leasing companies, public transport and expense declaration systems.

By using the Fynch platform, entering travel data only takes a few minutes. In the system, the employee chooses his or her starting point and the software calculates the number of kilometers. This also eliminates errors in the number of kilometers. Employees who haven’t filled in anything yet will automatically receive a reminder e-mail. If your employees use the Fynch app, even the kilometers are calculated automatically.

Fynch also collects and compares the various mandatory data sources and processes them correctly in the annual WPM report.

In short: with Fynch, CO2 reporting is error-free and fast.

The basic version of Fynch (Fynch WPM) is arranged within 1 day. The implementation of Fynch Pro is arranged within a maximum of 5 business days.

Your personal data is only visible to you, unless an employee of Fynch Mobility needs to view the data to help you with something. The data is stored anonymously in the database and can only be processed at an aggregated level (big data). In this case, the individual data points can never be traced back to your account. All data is stored securely and completely AVG-proof in our database.

You decide how long we store your trip data.

Also, visit our page on privacy and our privacy statement.

By rewarding desired behavior and providing insight into your own performance. For example, sustainable travel is:

- Not traveling (working from home)

- Public transportation

- Bicycle

- Electric car

With a sustainable mobility policy, the sustainable choice is rewarded more than the non-sustainable one. This does involve more administration and control.

With Fynch we take this administration out of your hands and motivate employees to travel sustainably by rewarding them and giving them insight into their personal behavior. We arrange your mobility policy in our platform, the employee registers with the app how he/she travels and the app automatically links the correct compensation to it. An excess report prevents incorrect use.

You can read more about behavioral change and how we apply this here.

No, the system is so intuitive that you and your employees can get up and running with it in no time.

Fynch is available for international corporations, SMEs, and ZZPs (through the app stores). The cost of Fynch depends on the number of licenses and the desired modules (see our packages). To indicate the costs, we would like to meet you. Schedule a free consultation now.

Client cases

...is supported by Fynch through its innovative mobility platform in achieving the objectives of the new mobility scheme.

View this case

...ultimately found that Fynch offered the most options to meet the needs of our diverse workforce, from mechanics to managers.

View this case