This is how you easily create a sustainable mobility plan

Creating a sustainable mobility plan becomes easier with these 5 tips.

Previously, as an employer, you reimbursed a maximum of €0.21 per kilometer to your employees. Regardless of whether it was commuting or business kilometers and regardless of whether they actually traveled. During vacations or illness, it simply continued.

This has since changed considerably. For example, the maximum tax-free kilometer allowance has been increased to €0.23 per kilometer as of 2023, and as an employer you have to deal with other challenges. Consider, for instance, the desire of employees to work from home or not, the importance of sustainable solutions and the obligation to keep track of CO2 emissions from work-related kilometers. How do you deal with this properly? And how do you encourage sustainable mobility among your employees? The answer is: make a clear plan. These 5 points will help you draw up a sustainable mobility plan.

Point 1: Sustainability

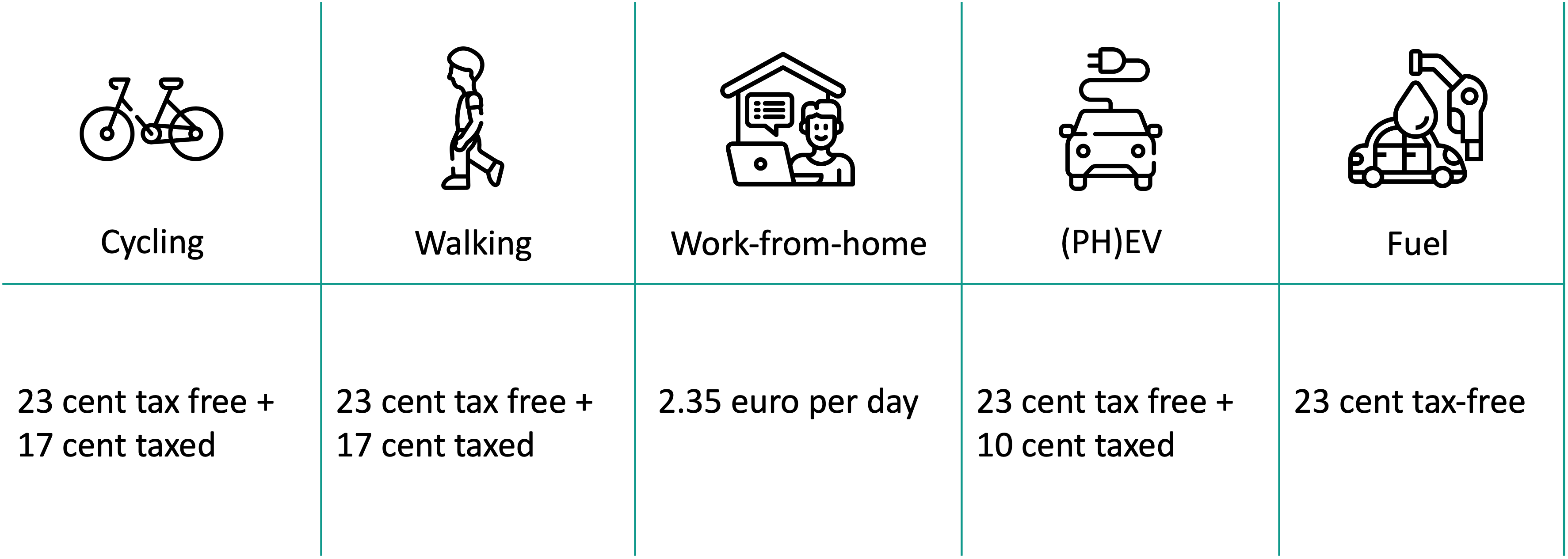

27% of the CO2 emissions are related to how we travel. And about half of these kilometers are work-related. A great opportunity for you as an employer to help create a cleaner environment. How? By rewarding sustainable behavior among your employees. You include this in your mobility plan. In the picture below a clear example is illustrated:

This differentiated kilometer reimbursement encourages employees to choose sustainable transportation… Think of the bicycle, electric car, public transport or walking. For example, give a kilometer reimbursement of € 0.40. Of which €0.23 is untaxed (net) and €0.17 is taxed (gross). Encouraging carpooling with a small reimbursement is of course also among the options.

Tip: If you reduce the kilometer reimbursement for fuel vehicles to, for example, €0.11 per kilometer you will have €0.12 remaining which you can allocate to the sustainable choice, such as the bicycle, on a net basis.

Also, motivate working from home. This can be done very easily by including work-from-home reimbursements in your mobility plan. Because traveling fewer kilometers for work also helps reduce CO2 emissions. The work-from-home allowance is €2.35 net per day.

Tip: The amount of €2.35 is per day is what you are allowed to pay out net. You can increase this amount and keep it net by using the free space in the WKR (working expenses scheme). If there is no room in the WKR, then € 2.35 remains net and everything above it is gross.

Point 2: Declarations

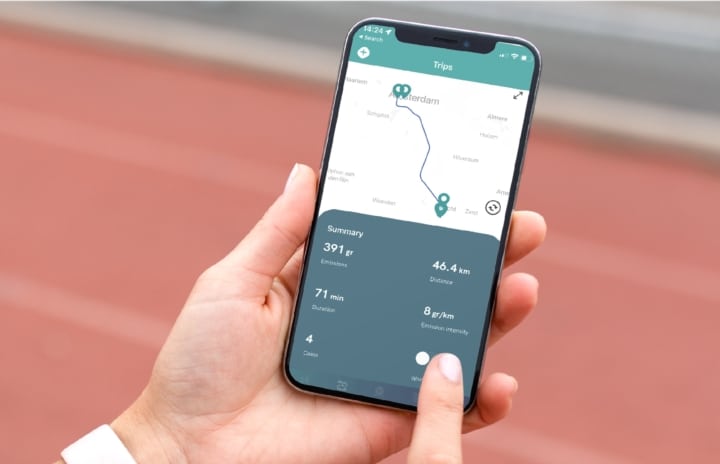

When creating a sustainable mobility plan, it is important to consider expense claims. Because the mandatory collection of all business kilometers and commuting for companies with more than 100 employees, causes enormous administration. In addition, you may only reimburse tax-free trips and work-from-home days. The accountant already sees you coming with a folder full of Excel files… With Fynch’s app, all work-related kilometers are automatically recorded and reported. So you automatically collect all data for the tax authorities and your CO2 reporting (WPM and CSRD) and avoid a lot of administrative hassle.

Point 3: Behavioral Change

We all want a more sustainable world. It just gets a little harder if we have to sacrifice too much to do so. Behavioral change is the key. And it sounds so easy, but changing your behavior is quite difficult. It often works in the short term, but over time we often fall back into our old habits. The same goes for your employees. For example, give your employees insight into their data. Such as the traveled kilometers, minutes moved, and the corresponding amounts of CO2 emissions. Possibly with tips on how to reduce this.

You can also give employees additional incentives by working with a reward system. Consider attractive kilometer reimbursements and possibly additional daily bonuses. Rewards can also come in the form of time (days off) and convenience. Often this is even more effective than money. This way, your staff has an extra incentive to make different, more sustainable choices in the long run as well.

Tip: Encourage behavior change by organizing mutual challenges. And reward them with a nice prize. A compliment at times can also be very motivating.

Point 4: Vitality

Vitality is also an important part of creating a sustainable mobility plan. Just look at the table under point 1. With this, you encourage more vital and active travel among your employees by rewarding healthier choices. And honestly, as an employer, you want healthy and vital staff. For several reasons. A healthy employee calls in sick less often enjoys their work more and is usually a pleasant colleague.

This is how you encourage employees to make healthier choices:

- Establish a kilometer reimbursement for walking.

- Offer the employee a bicycle with an interest-free loan and use the kilometer reimbursement to pay off the loan.

- A business lease bike is of course also possible, but then there is no right to a tax-free kilometer reimbursement (taxed, or untaxed using WKR is possible) and the employee pays a 7% additional tax.

- Private Lease is also an option, there is a right to compensation and the employee rides a new bicycle with maintenance and insurance properly arranged. A BKR registration is often necessary.

Tip: Are some employees unable to bike to work due to distance or job duties? As an employer, reward them for traveling by public transport or public bicycle instead of the (lease) car. In this way, you can avoid awkward looks at the workplace.

Point 5: Legislation

Do you have more than 100 employees? If so, the Reporting Requirement Work-related Mobility of Persons is just around the corner. This means that from 2024 onwards you are obliged to report the CO2 emissions from commuting and business kilometers of all employees. The responsibility for this lies with you as an employer. It also requires action from your employees. You can hardly keep track of everyone’s kilometer registration yourself. Therefore, choose a convenient and reliable solution and document this when drawing up a sustainable mobility plan.

Tip: Fynch Mobility offers an application that very easily records all work kilometers and converts them into CO2 emissions. This saves you (and your employees) a huge amount of time and money. This way you help your employees as much as possible.

In addition to the Reporting Requirement WPM, as a large company, you may soon be required to share information about your sustainability performance. This directive is set by the EU and is called the CSRD (Corporate Social Responsibility Disclosure). This means you will have to share information about environmental impact, social responsibility, and community engagement in your annual report. The CSRD goes into effect in 2024 and depends on the size of your company.

Fynch Mobility is eager to help you set up a smart and sustainable mobility plan. This way you automatically comply with the new legislation, stimulate vitality and behavioral change in the workplace, make registration as easy as possible for your employees and save a lot of time and money through automated (tax-proof) declarations. Contact us to discuss the possibilities.