In conversation with Wilco Dijkstra – Concrete examples for filling the Green Labor Agreement

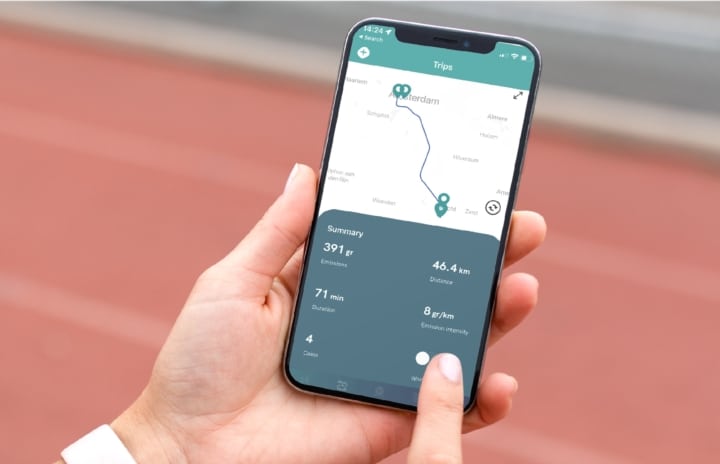

Sustainable Mobility & the Green Labor Agreement was the topic of the first Fynch Expert Sessions held in Utrecht on the 28th of September.

A crucial part of sustainable mobility is understanding Green Labor Agreements and how employers can leverage them. This is where Wilco Dijkstra, Commercial Director of NFP Groep (FiscFree®, NFP Fietslease en Trappers), comes in. In this blog post, he will share concrete customer cases to illustrate what employers can offer in their Green Labor Agreement. These include incentive plans for bicycles, heat pumps, solar panels, and more. These are not only benefits for employees, but also for employers.

Tell us about yourself and NFP Groep

Tricky question, what would you like to hear? I am broadly interested and therefore enjoy many things. From an early age, I have been interested in what moves people. I regularly ask questions that people do not always expect because it goes beyond the superficial, phrased out of genuine interest in seeking the drivers of that person. I use this in my work as well. Besides focus, an important pillar to be successful, in my opinion, is to be able to “feel” what each stakeholder feels. Being able to put yourself in different positions. That way you can recognize needs, opportunities, and threats. And use that information to adapt your services as well as possible.

At NFP Group, we unburden the employer and make it easy for employers to fulfill the green labor agreement for employees. Which subsequently makes employees happy. We do this with 3 different services: FiscFree®, NFP bicycle lease (business), and Trappers.

We have been active since 1995, and are market leader with thousands of employers as clients from well-known large corporate employers in the Netherlands, such as banks, employers from industry, retail, financial institutions, many hospitals and healthcare institutions, schools, municipalities, etc. to SMEs. In all industries, our clients collectively have over 1,100,000 employees.

What can already be done: What tax regulations can help you offer green labor agreements?

Currently, there are 2 tax arrangements that employers can deploy, one within the Working Costs Regulation (WKR) and one outside the WKR.

Tax arrangement 1 – The Work Cost Regulation (WKR)

The WKR can implement the green labor agreement in a simple and financially interesting way, this can for example be done with what we do at FiscFree®.

But what is the WKR?

- The WKR is a tax space for untaxed reimbursements and benefits in kind from the employer.

- Fiscal space is a percentage of the total fiscal wage bill. As of Jan. 1, 2024, it is 1.92% up to €400K and 1.18% above €400K.

- Use this space to offer green deductible fringe benefits to your employees.

Why should you as an employer use the WKR to implement the green labor agreement? Because as an employer it does not have to cost you any money (in fact you realize a financial saving), and the employees benefit from an average of 40% tax benefit.

An example of a green deductible fringe benefit is offering a bicycle plan. The bicycle plan is the second most popular fringe benefit in the Netherlands after pension.

How does this work?

You can use the space to barter with your employees by using the cafeteria model within the WKR. The employee saves an average of 40% by paying with the gross salary instead of net salary and the employer saves an average of 18% on social charges by offloading the taxable payroll. This creates a WIN-WIN for both parties. It is about redeeming a gross wage component, it can also be overtime, excess vacation hours, year-end bonus, etc. in addition to gross wage.

All of this must be recorded in an employment contract supplement (AAO).

Why do employers offer a bike plan?

A bicycle plan supports various HR and organizational goals, such as:

- Being an attractive employer

- Vitality, sustainable employability

- Tackling parking problems in a positive way

- CO2 reduction (also interesting in the context of the WPM)

- And it’s…green!

A bike plan facilitates employees to acquire a more sustainable mode of transportation with tax benefits.

You researched the bike plan, what were the results?

Correct, in 2022 we did the NFP “Bike to Work Survey” among our clients who together have over 1,100,00 employees. Some of the results of this survey are:

What are the effects of the bike plan on cycling behavior?

- 52% of employees who participated in the bike plan said the plan encourages them to bike to work.

- 81% of the participants indicated that since the bike plan, they are much more likely to use their bikes for private use as well. A nice side benefit for employers who want to support vitality.

Why is the bike chosen for commuting?

- 42% to start work fresher and “then I’ve already been active”

- 37% because it’s a better way to leave work behind after a long day

It makes you start your day feeling good because you have been active before work starts. And after work, people also report that they feel better. While cycling, they can clear their minds and experience being more present and more relaxed at home.

Which bike do employees who participate in the bike plan choose most frequently?

63% choose the electric bicycle. This is also often the wish of the employer because with an e-bike you can cover longer distances, making it more likely that the bicycle will then also be used for commuting. The remaining 37% are regular bikes, cargo bikes, racing bikes, all-terrain bikes, etc.

What about the purchase price?

The average purchase price of a bicycle through for example the bike plan we offer at FiscFree® is about €1820. This is a substantial amount, and many employers don’t want to sacrifice €1820 of their tax allowance for one bike. Therefore, many employers set, for example, €1000 as the amount you can pay with your gross salary. The employee then pays any remaining net amount themselves. By including the rule that you can only participate once every 3 or 4 years, many employees can participate in the bicycle plan. As an employer, you determine the rules of the game, and we advise employers in this process.

Besides the bike plan, what other green-related options do your clients offer?

Our clients encourage the use of green energy by offering tax-advantaged hybrid heat pumps and solar panels.

How does that work? It works just like the bicycle plan. The employer informs the employee that, for example, a maximum of €2000 (what can be paid with gross salary), on which the employee achieved a financial benefit of on average 40% (€800). This is on top of the government subsidy plan! We recommend that you participate for example once every 10 years to allow as many employees to participate.

What would you like employers to take away?

Reserve part of the WKR budget for deductible fringe benefits as mentioned above. Talk to the finance department about this. Also, some employers keep some budget remaining each year with which nothing is done, this is a shame because you cannot carry it over to the next year. As an employer, you thus miss the opportunity to realize financial savings yourself and also the chance to make your employees happy.

Tax arrangement 2 – The lease bicycle arrangement

This is the simplified lease bike plan that took effect on January 1st, 2020.

What is the lease bike arrangement?

Under the lease bike arrangement, the employer provides a lease bicycle to its employee. The employee always pays 7% gross additional taxable income and may therefore also use the bicycle for private purposes without restriction. No untaxed net travel reimbursement may be paid on the days the lease bike is used for commuting.

The lease bike arrangement falls outside the scope of the WKR, there is no participation limit, and can therefore be used without limit by any employer. It works just like the lease car that everyone is familiar with.

What is part of the lease amount?

With our service, NFP Bicycle Lease, we offer an all-in rate:

- Use of the (electric) bike

- All-risk insurance, maintenance, repairs & service

- We offer great comfort for the lease driver because service and maintenance are simply done at the lease driver’s home, employer’s location, or any other desired location.

- Lease term choice of 12, 24, 36, 48 months. The employer determines what the employee may choose from.

- Use of the customized NFP Bike Lease platform per employer, help desk, and supported communication

What are the costs for the employer and what are the costs for the employee in a lease bike arrangement?

That depends on the employer, they decide what the lease bike arrangement will look like.

We have clients where the employer says it will cover all the costs. Those are the employers where the employee only pays a 7% gross addition. Which amounts to a few euros net per month.

We also have clients where the employer says they want to pay part of the cost. These are the employers who want to encourage the lease bike arrangement. In this case, the employee pays the remainder with their gross salary. The employee gets an average of 40% tax benefit on the amount that is paid by them.

Finally, we have a concluding group of customers who say, I want it but it shouldn’t cost me anything as an employer! Then the employer facilitates. Even then it is still interesting for the employee, who pays the entire amount with their gross salary and receives an average tax benefit of 40%. The 7% additional tax rate will also be added to the payment. Nonetheless, it continues to be financially interesting for the employee and at the end of the lease period, the employee can take over the lease bike for an attractive fee if desired.

Can the company lease bike be combined with a company lease car?

Yes, an employee with a lease car can also participate in the lease bike arrangement. It is particularly interesting to get this group moving as well. This is also a way to indirectly encourage employees with a lease car to make more sustainable choices. There is no obligation to use the lease bike for commuting.

Do you have clients who offer both the bike plan and the lease bike plan?

Yes! There are 4 main reasons for this:

First, offer a choice to the employee.

The employer wants to use all tax-advantaged options and let the employee choose. Purchase the bike with a tax benefit and arrange maintenance, insurance, etc. themselves, or lease a bike with a tax benefit including insurance/maintenance, etc. This freedom of choice is highly appreciated among staff. Buying a bike with a tax benefit has the advantage that it does not affect the untaxed net travel reimbursement. With a lease bike, the employer will not reimburse the employee on the days on which the bike is used for commuting. Often that amount is used by the employer as a contribution which reduces the lease rate payable by the employee.

Secondly, the lease bike arrangement creates additional room in the bike plan.

At FiscFree® we organize that employees who join the lease bike arrangement, no longer join the bike plan. This leaves more room for employees who would like to join the bike plan.

Third, the lease bike arrangement is always available.

Should the budget for the bike plan run out at some point, the employee can always join the lease bike arrangement. After all, it is always available. Making it convenient for the employee and the employer.

Fourth, 1 + 1 = 3

Our clients who offer both a bike plan and a lease bike plan show a higher number of participants compared to clients who offer only the bike plan or only the lease bike plan. Offering both arrangements, show more happy employees, and a happy employer.

What else would you like employers to take away?

Use the tax regulations that are available to offer (deductible) secondary (green) benefits. Especially in these times of tight labor markets, these conditions are more important than ever in recruiting new staff and retaining your people. I think it is a missed opportunity if you as an employer do not take advantage of this. Especially since it doesn’t have to cost you anything as an employer and it can make your employees happy.