Low Car Diet 4.0

At the end of 2022, Fynch took over the activities of Stichting de Reisbeweging. One of the activities was the Low Car Diet, a competition in which companies competed among themselves for one month to save as much mobility-related CO2 as possible. This approach needed a rigorous revision. In this newsletter we tell you more about these changes and why it is very relevant now.

The Low Car Diet was about behavior change; so was Fynch, of course, after all, if you do what you always did, you get what you always had. So much for the similarities. Based on the lessons learned, we built a completely new program. In doing so, we assumed that Fynch should fit in with existing business processes and specifically the process around declaring mobility and working from home.

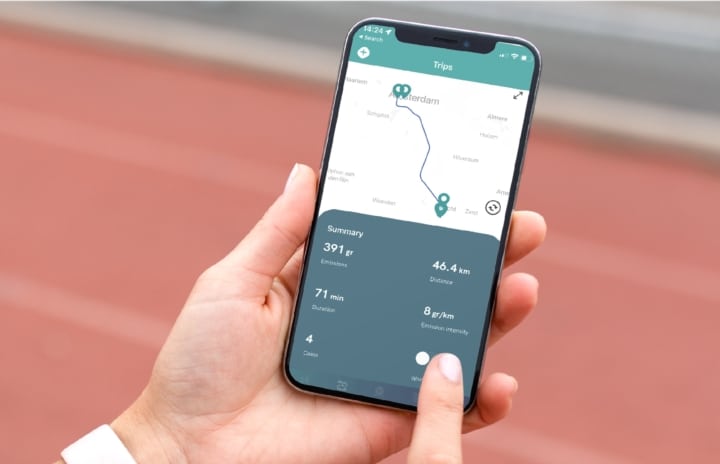

📆 Administrative convenience: Fynch takes the friction out of the travel expense declaration process, leaving manual work-from-home days & travel expense declaration in the past. Because the employee uses Fynch to declare trips and work-from-home days, we can also reward them for sustainable behavior.

🛣 Incentives for sustainable behavior: All mobility reimbursements easily adjustable by mode of transportation (biking and walking higher than a car, for example);

🚲 Vitality: The Fynch app rewards employees with coins for active mobility (biking and walking);

🌳 CO2 reduction: The Fynch app rewards employees with coins for sustainable travel behavior (cycling, walking, working from home, public transport) in addition to a variable kilometer reimbursement;

📈 CO2 reporting: Through the Fynch Platform (web) you get insight into the build-up of CO2 emissions caused by mobility and various other mobility KPIs. Real-time.

Needless to say, Fynch is fully GDPR-proof and the app user remains in control of all data. We are also ISO27001 certified.

Why especially relevant now?

💡 Legislation: With the Reporting Requirement Work-related Mobility of Persons approaching (2024), the government is requiring organizations with at least 100 employees to record and report travel behavior.

💡Employer Attractiveness: Flexibility, variable travel allowances, a simple system for recording travel and work-from-home days.

💡Fiscal: Only actual travel and work-from-home days may be reimbursed untaxed. The burden of proof is on the employer.