Flexible travel reimbursement 2022: how will you manage it?

Now because of COVID-19 we mainly work from home, and many employees do not meet the conditions for receiving untaxed travel reimbursement. Flexible travel reimbursement will have to replace this.

In fact, an employee must travel for work at least 60% of the assumed 214 working days to receive an untaxed travel allowance.

During the first COVID-19 wave, a temporary exception was made for this and the untaxed travel reimbursement was allowed to continue, but as of Jan. 1, 2022, another solution is needed.

Not sure yet how your organization will handle this? Then let Fynch help you!

What are your options?

The Financieele Dagblad states that as an employer you have two options:

- Review at the individual level which employees will meet the 60% rule in 2021;

- Reimburse employees for days actually traveled

Because it is difficult to estimate the number of travel days in 2021, and employees may have an interest in estimating it higher, this could mean an after-tax charge and additional administration.

So those are unnecessary costs! With that, Option 2 is more attractive, where Fynch helps you map the days traveled.

Fynch makes it easy!

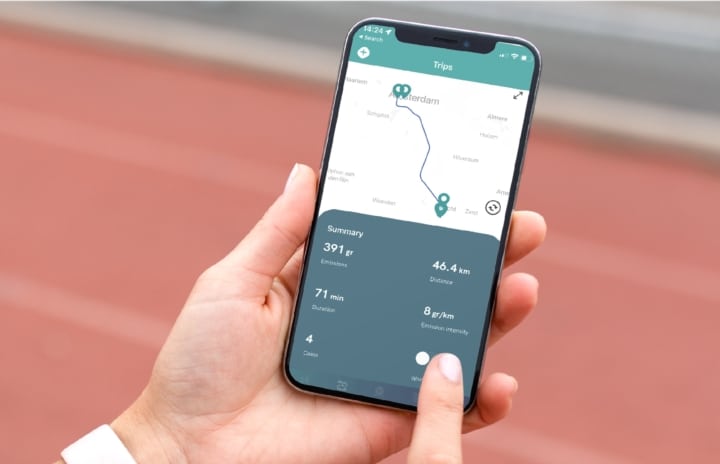

The Fynch App automatically records your employees’ trips. All an employee has to do is check that the trip is correctly labeled as work-related.

After that, it is easy to create an Excel printout of the reimbursable trips. For large organizations, we can even fully automate the declaration process with the payroll software.

In addition, Fynch rewards sustainable and healthy travel choices, such as cycling, walking around your (home) workday, carpooling and public transport travel (now with COVID-19 only outside peak hours). So you kill two birds with one stone!